Deferred compensation plan calculator

The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Tax Calculator Hi Res Stock Photography And Images Alamy

Find your employers plan.

. Thats why one common strategy is to use a deferred comp plan as a bridge in retirement income. It can fill the gap between income. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

457 Savings Calculator Overview. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Savings Boost Calculator See how increasing your 457 Plan contributions can provide a valuable.

How long will my money last. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Qualified deferred compensation plans 401 ks profit-sharing plans incentive stock options pensions are protected by the Employee Retirement Income. Learn what type of. This calculator helps illustrate what it might take to eventually reach your objectives.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. This calculator shows how cutting back can add up over time and increase your savings.

This calculator uses your personal information to develop a custom savings forecast that takes into consideration pension social security the deferred compensation plan and other. Search by state to find your employer-sponsored deferred compensation plan administered by Nationwide Retirement Solutions. Alameda County Deferred Compensation Plan Plan Resources Quick Actions.

Then download and share your results with your. It provides you with two important advantages. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations.

Both qualified and nonqualified plans are funded with tax. First all contributions and earnings to your 457. How much can I withdraw.

Retirement savings plans like 401ks 403bs and IRAs are considered qualified deferred compensation plans. DCP savings calculator DCP retirement planner Plan 3 members. Calculate your potential income from the deferred comp plan.

Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. A 457 savings plan is a great way to save for retirement if youre fortunate enough to qualify for one. Keep your goals and deferral options in mind as you complete this planner.

Contributions to the Plan can be made on a pre-tax or Roth. A 457 savings plan is a special kind of deferred. Our Resources Can Help You Decide Between Taxable Vs.

A deferred compensation plan is another name for a 457 b retirement plan or 457 plan for short. Select your monthly DCP contribution. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

How much can I save. Deferred compensation plans are designed for state and municipal workers as well as. The Deferred Compensation Program has these calculators available.

The State of Illinois Deferred Compensation Plan Plan is a supplemental retirement program for State employees. Youre eligible for retirement. Get contact information for your financial guidance professionals and plan.

A 457 can be one of your best tools for creating a secure retirement. Nonqualified Deferred Compensation Planner. Investor Type What type of investor are you.

Compound Interest Calculator Daily Monthly Quarterly Annual

Vrs Contributions

Paper With Corrective And Preventive Capa Action Plans On A Table Stock Image Image Of Management Line 204992941

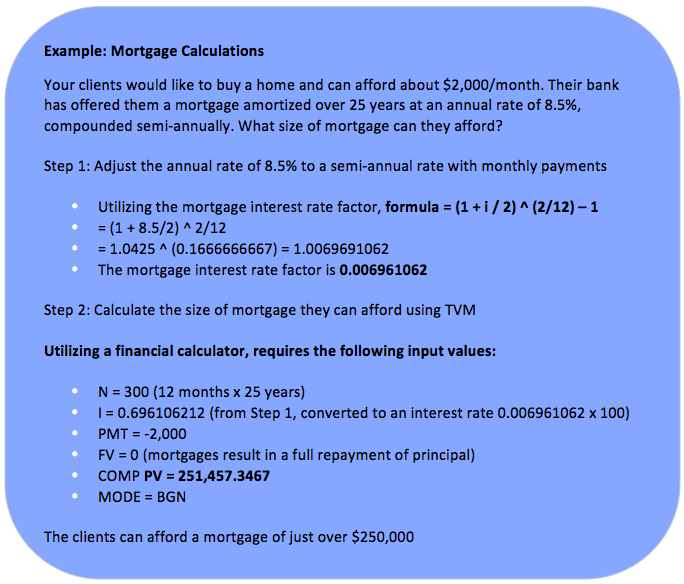

Time Value Of Money Tvm Calculations Plannerprep

457 Deferred Compensation Plan

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

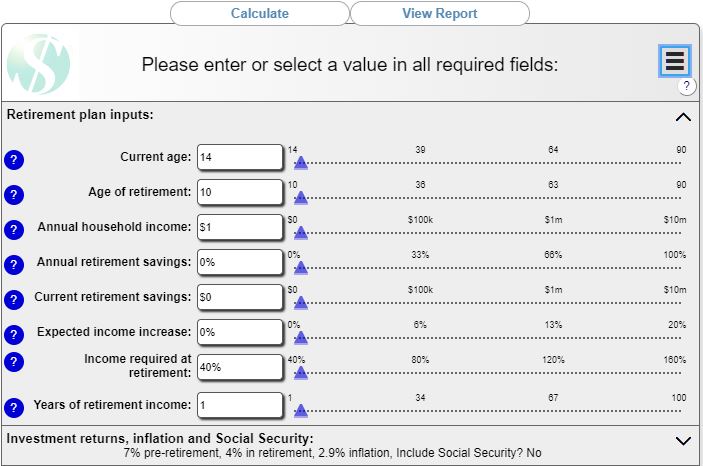

Retirement Calculator Sams Investment Strategies

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Compound Interest Calculator Daily Monthly Quarterly Annual

913 457 Images Stock Photos Vectors Shutterstock

457 Plan For Teachers The Enterprising Educator

Financial Calculators

How To Calculate Rmds Forbes Advisor

913 457 Images Stock Photos Vectors Shutterstock

403 B Vs 457 B What S The Difference Smartasset

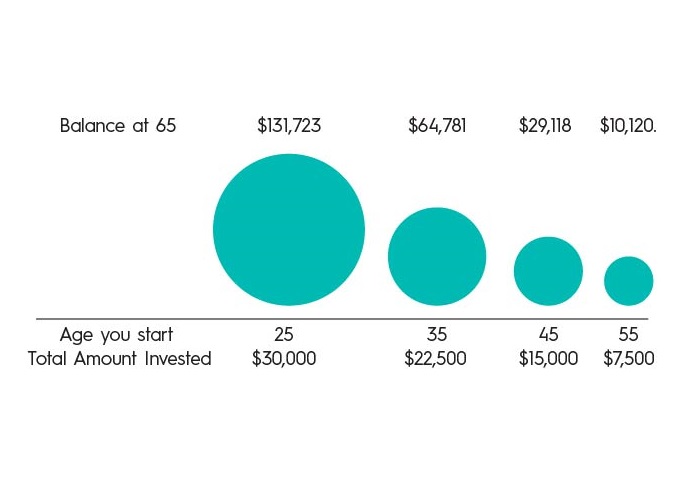

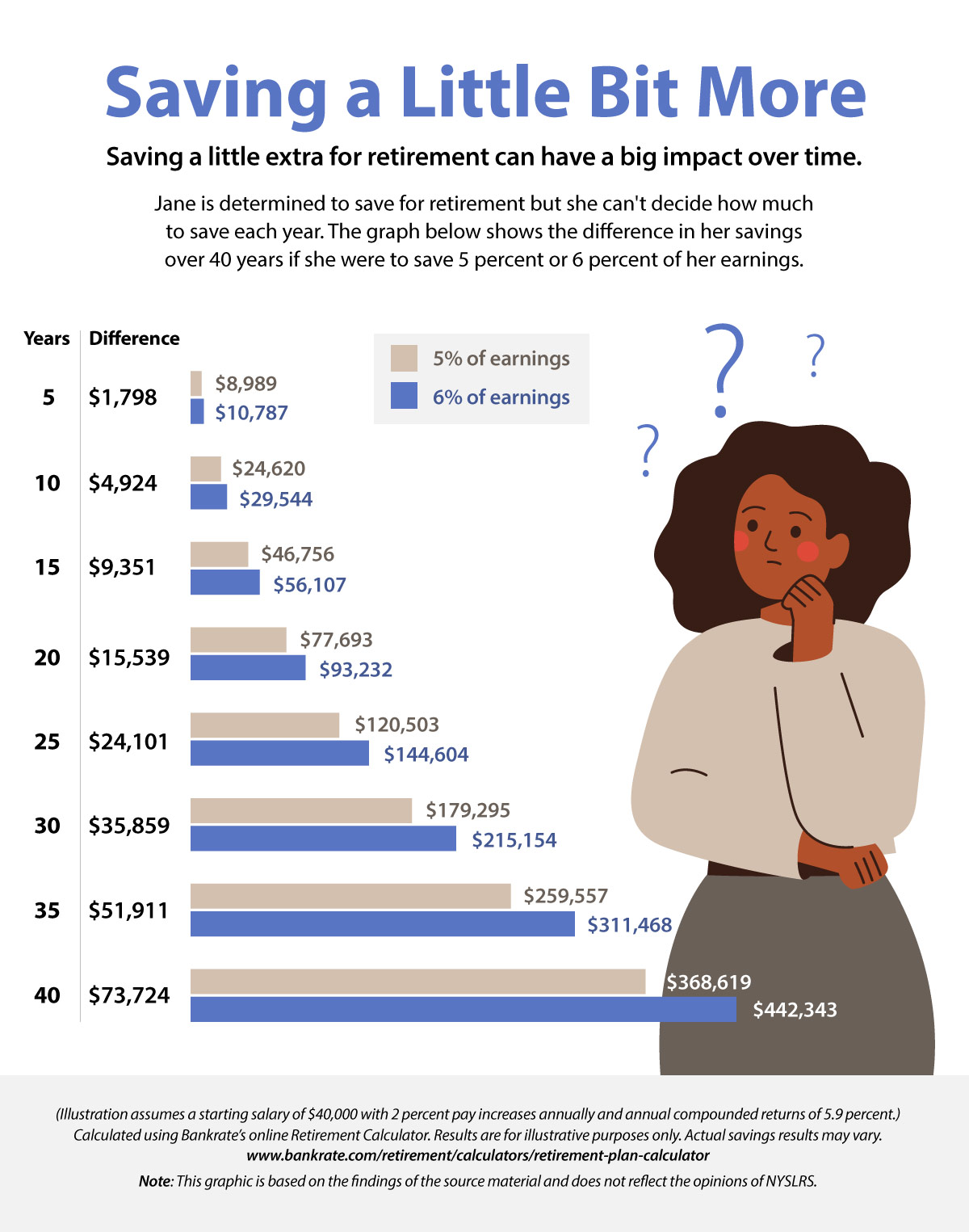

Give Your Retirement Savings A Boost New York Retirement News

913 457 Images Stock Photos Vectors Shutterstock